Directors and Officers Beware!

The majority of people who find themselves in the position of making organizational decisions remain blissfully unaware of the substantial personal risk they have in doing so. It’s easy to assume that the wide array of insurance policies that their organization pays for each year will protect them from any exposure that exists. It should be safe to assume that between the worker’s compensation liability, professional liability, employer practices liability and, if nothing else, the general liability insurance policies; the organization should have ample coverage to deal with all potential risks that exist. However, unless the organization you are working with has purchased a Directors & Officers (D&O) liability insurance policy, any personal liability you may hold is not protected at all. And, while, it is true that officers of for-profit companies are commonly sued; it is also true that directors and officers of non-profit organizations similarly run the risk of being personally liable for their decisions – even those who are simply volunteering their services.

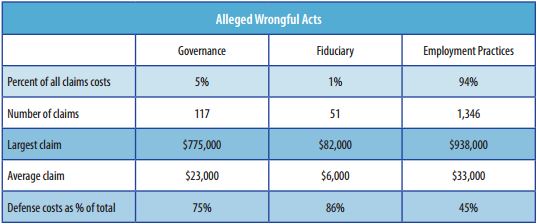

Directors, officers and trustees of non-profit organizations are exposed to a variety of personal risks, depending on what their duties are. The three major categories of risk for non-profit members are governance liability, fiduciary liability and employment practices liability. In some cases, such exposures are not covered perils under traditional liability policies, and when they are; the beneficiary of the liability protection would be the organization itself, not the individuals within it. A decision-making individual within a charitable organization can be personally sued by vendors, customers, employees, competitors, government regulators and even donors. And while your particular chosen organization may in fact be highly ethical and very functional; all it takes is a claim of wrongdoing to get a costly suit going. As the chart below indicates, defense cost makes up a significant portion of all claim examples:

Graphic Source: Insurance for Non-profits

Some states have enacted statutes to help protect directors and officers from liability. For example, California, the state in which I write this article from, has enacted Cal. Corp. Code § 7231, which provides for “no liability based upon any alleged failure to discharge the person’s obligations as a director…”, but ultimately fails to protect said director from the reach of the federal government. Even where the state statutes are governing; you would still have to expend personal income to defend yourself in the doomed lawsuit. Also, it’s important to remember that not all non-profits are charities and therefore not protected by so-called “Good Samaritan” statutes; Home Owner’s Associations are considered non-profits as well. Do you, or your spouse, carry volunteer positions on your HOA board? If so, then you should be concerned about your liability there as well.

To ensure that you have the proper protection in place, there are several things to look for. Be sure to ask for a copy of the organization’s D&O policy “declaration page”, including the endorsement listing and any relevant amendments. Review the documents carefully and be wary of exclusions for claims that arise from employment-related issues because, as previously noted, the majority of claims arise from employment related issues. Additionally, as a coverage failsafe, you should verify that your own personal homeowners insurance and/or umbrella liability insurance policies do not exclude your actions in volunteer positions. Along the same line, confirm that the D&O policy meets the minimum limits of your personal liability insurance carrier(s). Finally, it would be ideal for the organization’s D&O policy to have a “per occurrence” policy form rather than a “claims-made” form to avoid coverage gaps in the future; though that is not always available.

There are many factors to be concerned with, and you might be overwhelmed by the multitude of things you are responsible for checking. This burden can be alleviated by obtaining a well trained insurance broker. For proper coverage coordination, clients who have D&O exposure should be using an insurance broker, rather than working directly with an insurance carrier. It is vital that your broker be well versed in personal liability and commercial liability product needs; rather than a broker who specializes in one or the other. If you haven’t ever heard of D&O liability insurance, it’s likely due to the fact that your personal broker is not adequately trained in commercial product offerings and doesn’t know the product exists.